unlevered free cash flow margin

Since revenue is 100mm and the EBITDA margin assumption is 40 EBITDA comes out to 40mm. Essentially this number represents a companys financial status if they were to have no debts.

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow also known as UFCF or Free Cash Flow to Firm FCFF is a measure of a companys cash flow that includes only items that are.

. It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made. Margin rates as low as 133. Unlevered free cash flow is also referred to as UFCF free cash flow to the firm and FFCF.

Unlevered free cash flow is the cash flow a business has excluding interest payments. Unlevered Free Cash Flow FCF Yield Formula. So these are the cash flow the company is free to use however it likes because it has already paid its bills and reinvested into future growth.

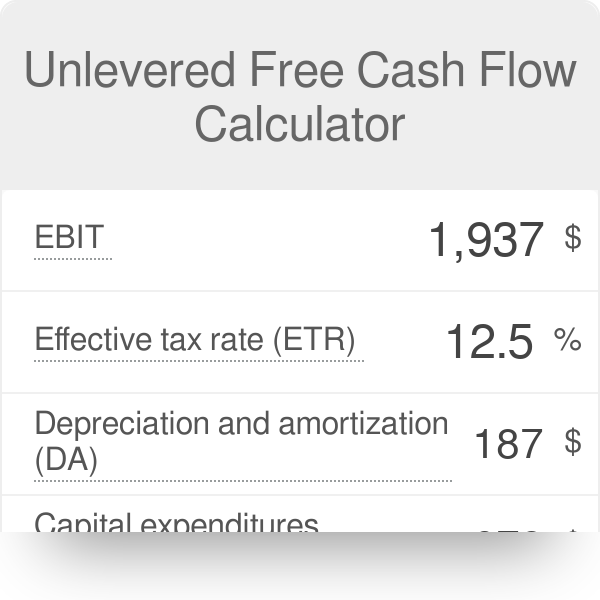

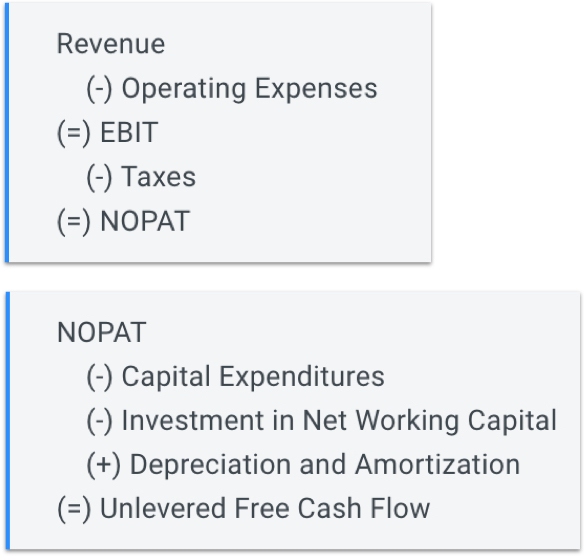

Unlevered Free Cash Flow is the amount of cash flow a company generates after covering all expenses and necessary expenditures. UFCF EBITDA - CapEx - Changes in WC - Taxes where UFCF Unlevered free cash flow EBITDA Earnings before interest tax depreciation and amortization CapEx. Unlevered free cash flow is visible to investors equity holders and debtholders in the company.

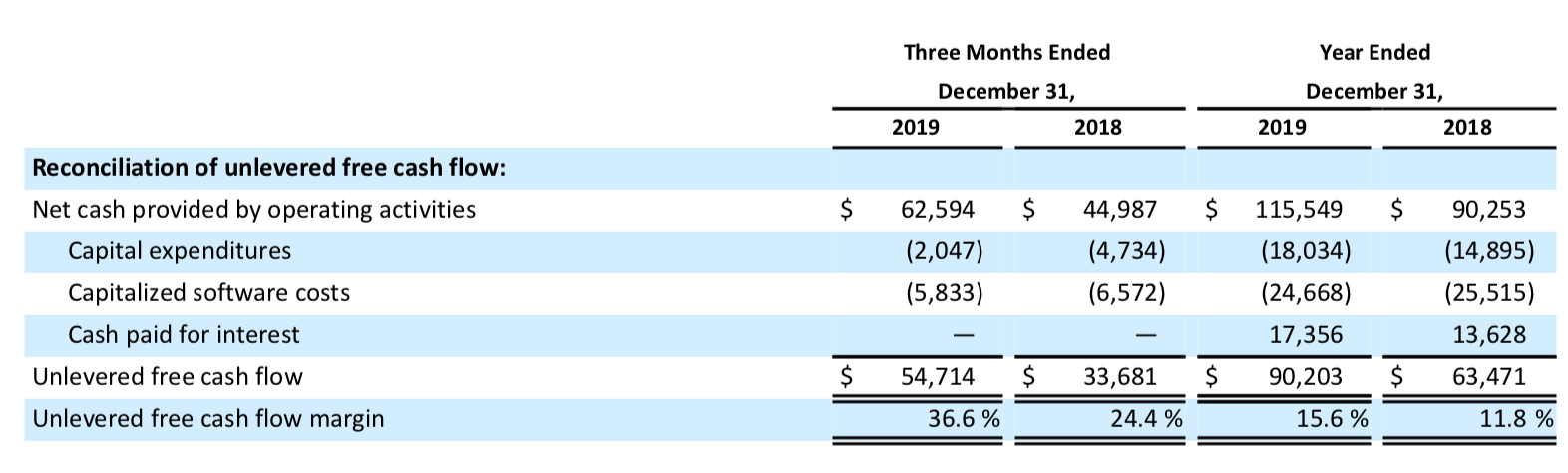

Unlevered free cash flow is the gross free cash flow generated by a company. Unlevered Free Cash Flow Margin means total Unlevered Free Cash Flowfor the current fiscal yearminus the Board-approved pro formaUnlevered Free Cash Flow for Targetfor the current fiscal year total Revenuefor the current fiscal year minus the Board-approved pro forma Revenue for Target for the current fiscal year minus one 1. Putting Together the Full Projections Unlevered FCF NOPAT DA - Deferred Income Taxes - Net Change in Working Capital CapEx And we know that NOPAT EBIT 1 Tax Rate.

Here we will be discussing the formulas for calculating the FCF yield or more specifically the difference between the unlevered and levered FCF yield. When filing the financial statement of a company UFCF are also reported. Lockheed Martins unlevered free cash flow margin decreased in 2017 58 -305 and 2019 95 -62 and increased in 2018 102 755.

Unlevered Cash Flow is calculated using the following formula. A reconciliation of non-GAAP financial measures to the most directly. This is the money that a company has before.

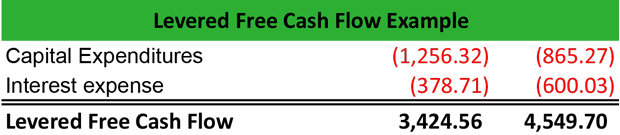

Leverage is another name for debt and if cash flows are levered that means they are net of interest payments. Unlevered free cash flow is usually only visible to financial managers and investors rather than to the average consumer. The difference between UFCF and LFCF is what financial costs they account for.

Unlevered free cash flow UFCF refers to the money available to a company without interest payments. Leverage is a term that financiers use to indicate the use of debt. Leverage is another name for debt and if cash flows are levered that means they are net of interest payments.

Meta Platformss unlevered free cash flow margin decreased in 2018 198 -319 and 2020 184 -353 and increased in 2016 270 240 2017 291 79 and 2019 285 437. We then subtract the 10mm in depreciation and. Ad Interactive Brokers offers some of the lowest margin rates compared to our competitors.

Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another. The name itself is a give-away. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business.

Meta Platformss unlevered free cash flow margin hit its five-year low in December 2020 of 184. Unlevered free cash flow UFCF is the cash flow available to owners of all sources of capital equity-holders mezzanine financing owners and debtholders. Unlevered FCF simply means looking at a companys cash flow before the effects of debt are taken into account ie CF to all the capital providers.

Lockheed Martins unlevered free cash flow margin hit its five-year low in December 2017 of 58. This represents the companys earnings from core business after taxes ignoring capital structure. Unlevered Free Cash Flow UFCF Formula The formula to calculate UFCF is.

Unlevered free cash flow is a theoretical dollar amount that exists on the cash flow statement prior to paying debts expenses interest payments and taxes. Unlevered free cash flow UFCF is the cash flow available to all providers of capital including debt equity and hybrid capital. Unlevered free cash flow is the gross free cash flow generated by a company.

Unlevered means that the free cash flow is free of leverage or debt and accurately depicts the amount of cash available to pay all stakeholders including both debt and equity holders. How to Calculate Unlevered Free Cash Flow. Unlevered Free Cash Flow EBITDA CAPEX Working Capital Taxes The formula that is used in order to calculate unlevered cash flow does not take into account debt or any payments that have to be made in order to settle the debts.

The short answer is no unlevered cash flow does not include interest. Unlevered free cash flow UFCF is an anticipated or theoretical figure for a business that represents the cash flow remaining before all expenses interest payments and capital expenditures are made. These financial obligations signify the difference between unlevered free cash flow and levered free cash flow.

It represents the cash available to grow a companys revenue-generating capacity using all sources of funds. Rates subject to change. Gross margin and variable marketing margin were 29 and 35 respectively despite increased media costs that were mitigated by strong media buying expertise and use of the Companys first-party data asset.

Client projections research reports and historical tax rates. Levered free cash flow on the other hand works in favor of the business that didnt borrow any capital and doesnt necessarily show a comparative analysis of each companys ability to generate cash flow on an ongoing basis. EBIT should exclude goodwill amortization per SFAS 142 if CY2001 or an earlier year is used to arrive at EBIT margin.

Unlevered Free Cash Flow Adjusted Net Income and Adjusted EPS. It is the cash flow of a company based on the belief that the company owes no debt therefore has no interest payments to make. The prefix un meaning not.

Related to or available to all investors in the company Debt Equity Preferred and others in other words Free Cash Flow to ALL Investors AND.

What Is Levered Free Cash Flow Definition Meaning Example

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

Levered Free Cash Flow Lfcf Definition

Understanding Levered Vs Unlevered Free Cash Flow

Cornerstone Ondemand It S Now About The Cash Flow Nasdaq Csod Seeking Alpha

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Calculator Ufcf

Free Cash Flow To Firm Fcff Unlevered Fcf Formula And Excel Calculator

Free Cash Flow To Firm Fcff Formulas Definition Example

Fcf Formula Formula For Free Cash Flow Examples And Guide

Discounted Cash Flow Analysis Street Of Walls

Discounted Cash Flow Analysis Street Of Walls

Free Cash Flow Big Sale Off 79

What Is Levered Free Cash Flow Definition Meaning Example

Fcf Yield Unlevered Vs Levered Formula And Calculator

Discounted Cash Flow Analysis Street Of Walls

Fcf Yield Unlevered Vs Levered Formula And Calculator

Unlevered Free Cash Flow Definition Examples Formula

Matthew Hogan Blog Estimating Domino S Pizza Free Cash Flow And Intrinsic Value Talkmarkets